Trade Credit Insurance

What is Trade Credit Insurance?

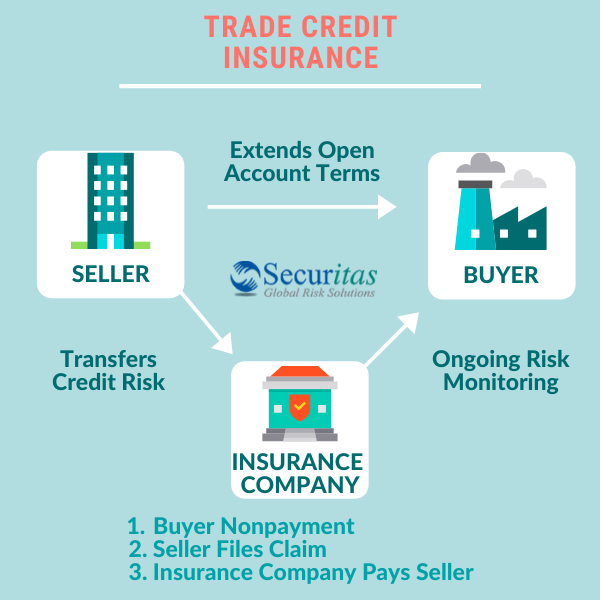

Trade Credit Insurance, sometimes called Accounts Receivable Insurance, is a method by which a seller transfers their accounts receivable credit risk (failure by the buyer to pay for goods or services) to an insurance company. This type of insurance protects a seller’s unpaid invoices and, where needed, WIP against the repercussions of a buyer insolvency/bankruptcy or protracted default (slow pay).

Trade credit insurance, at its core, protects a seller’s cash flow, earnings and potentially years of accumulated retained earnings from the impact of buyer nonpayment. When a claim is filed, the insurer steps in and pays the seller when the buyer cannot pay.

Our Guide to Trade Credit Insurance is a free resource that explains everything you need to know about benefits and key advantages of trade credit insurance.

What are the Key Benefits of Trade Credit Insurance?

A trade credit insurance policy offers much more than protecting a seller/business owner against the cash flow, earnings and balance sheet implications of a buyer non-payment. SME, middle market, Fortune 1000 and global multinationals have discovered and implemented trade credit insurance for a variety of reasons:

1. Incremental Gross Profit

There are a number of variables a seller considers when determining a credit limit or line to a buyer; management’s risk tolerance, seller’s gross margins, available credit information on a buyer, seller’s balance sheet capitalization and ultimate implications of a credit loss on cash flow/earnings. Users of trade credit insurance have come to appreciate how trade credit insurance coverage justifies increasing existing credit limits or lines.

Example of an Increased Incremental Gross Profit

- Seller determines, after considering of all variables, that a prudent credit limit to buyer should be $75,000

- Buyer ultimately gets to its credit limit and is put on “credit hold”

- Seller develops coverage of $75,000 through a trade credit insurance policy

- Seller increases buyer’s credit line from $75,000 to $125,0000

- Seller has provided $50,000 in incremental credit to buyer while achieving a net $25,000 reduction in credit risk to seller attributable to the buyer

- Seller achieves incremental sales of $300,000 (assuming 6 turns) to this one buyer

- Assuming 7.5% margin the seller achieves $22,500 in incremental gross profit, reduces credit risk to the buyer.

- When done over multiple buyers, incremental gross profit > cost of transferring risk and protecting the seller

- There are natural constraints when establish prudent credit limits.

By leveraging an insurance company’s balance sheet, seller’s are releasing that tension and increasing existing credit or trading lines to multiple buyers. The bottom line – trade credit insurance provides an ROI.

2. Improved Borrowing Power

Commercial bankers or any lender of external working capital views credit insurance favorably because it protects that very asset that is being financed – accounts receivables and work-in-progress.

Working capital revolvers support/finance inventory and a seller’s collective receivable credit risk. The credit risk of the receivables being financed is a function of the individual buyers. An insurance policy brings that credit risk on the covered buyers up to a Standard & Poor Rating of A+.

Often these credit facilities are governed by a borrowing base certificate to ensure that the extension of credit is in line with eligible collateral. Users of trade credit insurance have come to appreciate how trade credit insurance justifies the relaxing of borrowing base parameters to access incremental working capital.

%

On Average, Banks Lend Up to 85% On Insured Receivables*

*http://www.tradefinancemagazine.com/AboutUs/Stub/WhatIsTradeFinance.html

The following are examples of receivables that lenders will finance with trade credit insurance:

- Foreign receivables

- Buyers that represent a “concentration” relative to total accounts receivable

- Balances that are “cross aged” and thereby removing the entire customer balance

- Unbilled yet bona-fide receivables through performed services or products dispatched

Companies have unlocked tremendous amounts of incremental working capital through the use of a properly structured trade credit insurance solution. Here again, trade credit insurance provides an ROI through the utilization of incremental working capital.

3. Global Credit Resources

When entering new industries, geographical markets or trading relationships, prudence regarding the extension of credit is critical. Left to their own, sellers find it challenging and time consuming to ascertain necessary information to determine if and how much credit to extend to a buyer.

When partnering with a global credit insurer, a seller aligns themselves with unmatched credit resources. Credit insurers, from worldwide offices, have thousands of risk professionals and outside credit and collection resources working on behalf of their clients.

These resources are accessed by the knowledge of a trade credit insurance professional and the credit insurer’s web portal. The resources become an extension of the seller allowing for improved and more expedient decision making thereby allowing for internal resources to be shifted towards other objects/goals of the seller.

What Do I Need to Know About Policy Coverage?

Policies are written on an annual basis and can cover risks that are commercial or political. Once the policy is set, the credit insurer will assign the policyholder’s insured customers a specific credit limit, which is the amount covered if a buyer fails to pay.

Unlike other types of insurance, a trade credit insurance policy does not get filed away for renewal next year, it is a dynamic relationship. This type of policy can continue to change over the course of the year and the credit manager will play an active role in this process.

New buyers and additional coverage can be requested if needed. In this case, the insurance company will determine whether to approve the coverage by investigating the risk.

The insurer will continue to monitor your buyers and their creditworthiness. Companies we work with such as Atradius, Euler Hermes, and Coface will gather information about your customers by a variety of methods such as public records, receipt of financial statements, and information that is obtained through other policyholders that sell to the same buyer. This will be of great value to your company because the information you can access through the insurers database will help you make smarter business decisions.

Should you need to file a claim, our team of claims professionals will guide you through the process.

In a way, your credit insurer becomes an extension of your team. For example, if the records in the insurance carrier’s database suggest that your buyer is experiencing financial trouble, all policyholders that sell to that particular buyer will be alerted so that a plan can be set in place to avoid any losses before a claim is even filed.

How Do I Know Which Insurance Carrier to Choose?

There are many insurance carriers that offer trade credit insurance and each of them may differ in the amount that they decide to cover for your buyers, as well as their terms and conditions. Having a deep understanding of each of these differences will help you decide the best option for your company.

A trade credit insurance broker is invaluable in this process. Kirk Elken and Peter Seneca have over 35 years in the area of trade credit insurance. At Securitas Global Risk Solutions, we work for your company’s business interests, not the insurance carrier’s.

First, we work to understand your business needs and financial goals, key buyers, and credit exposures. Then, we send your policy application to multiple insurance carriers for quotes, which include buyer coverage commitments and proposed terms and conditions.

Next, we schedule a meeting to review the results. Using our knowledge of the insurance carriers, we can advise you on which policy will be best suited for you in terms of premium price, coverage, and advantages or disadvantages of working with each carrier.

After working together to elect the best policy at the most competitive price, we continue to work with and negotiate with the insurance carriers as your needs evolve.

How Much Does Trade Credit Insurance Cost?

The credit insurance premium is calculated by using a percentage of your turnover combined with level of risk. In other words, the number depends on who you are selling to, how much coverage your company needs for each customer, customer ratings, loss history, and the business sector.

On average, a trade credit insurance premium will be a fraction of one percent of company sales. The rate can be lower or higher depending on the variables listed above.

Does it Cost More to Use a Trade Credit Insurance Broker?

There is no additional cost to you for using a trade credit insurance broker. This means that on a given insurance policy, your rate will be the same whether you decide to undertake the process alone by going directly to an insurance carrier or work with a trade credit insurance broker.

In fact, you are likely going to pay less on your premium because you have your choice of multiple carriers, rather than being locked into one.

In Summary

Trade credit insurance is different than traditional insurance. It covers accounts receivable so that you can protect your company against buyer insolvency, slow-pay, and bad debt. In addition, a trade credit insurance policy is a partnership with the insurance carrier that can provide their database information and knowledge to improve your trade decisions. Companies can also benefit from trade credit insurance through its ability to affect your sales expansion to new and existing buyers.

Navigating the world of credit insurance and the insurance claims process can be complicated and challenging. Using a broker like Securitas Global Risk Solutions gives the balance of power back to the client in the form of our knowledge of the industry, our understanding of your company, and our ability to provide you the carrier that offers the best coverage at the lowest rate.

Download Your Free Guide to Trade Credit  Insurance

Insurance

Trade Credit News

Top 5 Benefits of Trade Credit Insurance

How does trade credit insurance work? Trade credit insurance is a type of insurance that protects businesses from the...

The Sudden Bankruptcy Filing of Vital Pharmaceuticals Inc / Bang Energy

Could a Large Manufacturer be a Credit Risk? Vital Pharmaceuticals is the third largest energy drink manufacturer in...

Major Country Risk Developments

Posted with permission from greatamericaninsurancegroup.com Overview The global economy has suffered four shocks...

900 West Valley Road, Suite 701 | Wayne, PA 19087

Tel. 484-595-0100 Fax. 484-582-0111

P.O. Box 3665, Tyger Valley, Cape Town 7536 South Africa

Tel. 072-308-1112

Insurance

Insurance