Receivable Put Options

What is a Receivable Put Option?

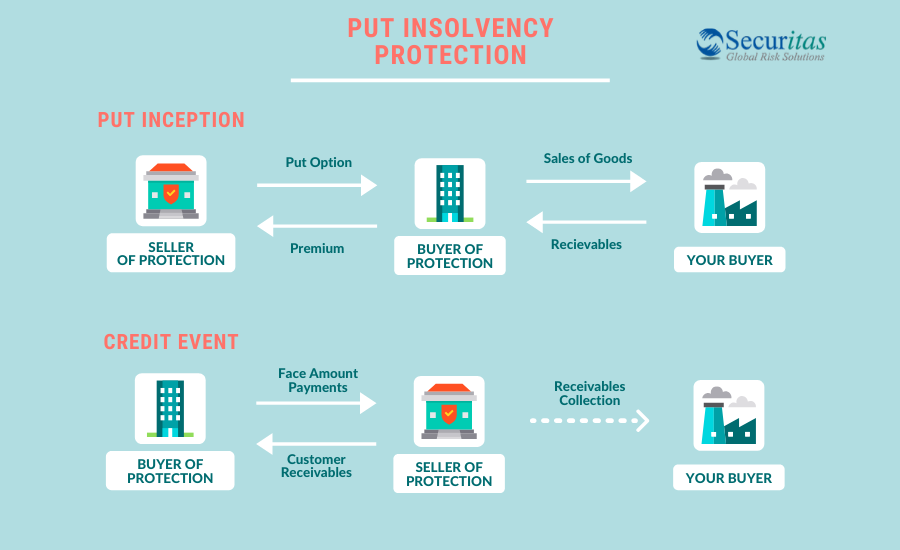

The Receivable Put Option Contract was developed as an alternative to credit insurance, or to provide protection to sellers if credit insurance wasn’t available. The Put Option Contract provides sellers the ability to put their unsecured trade claims to a counter-party in the event of insolvency or liquidation. The contract can be customized (tenor, indemnity, contract amount) to meet the sellers needs.

Why Purchase a Receivable Put Option Contract?

One should consider purchasing a Receivable Put Option Contract if you want to increase sales to new or existing buyers, or want to decrease accounts receivable credit exposure.

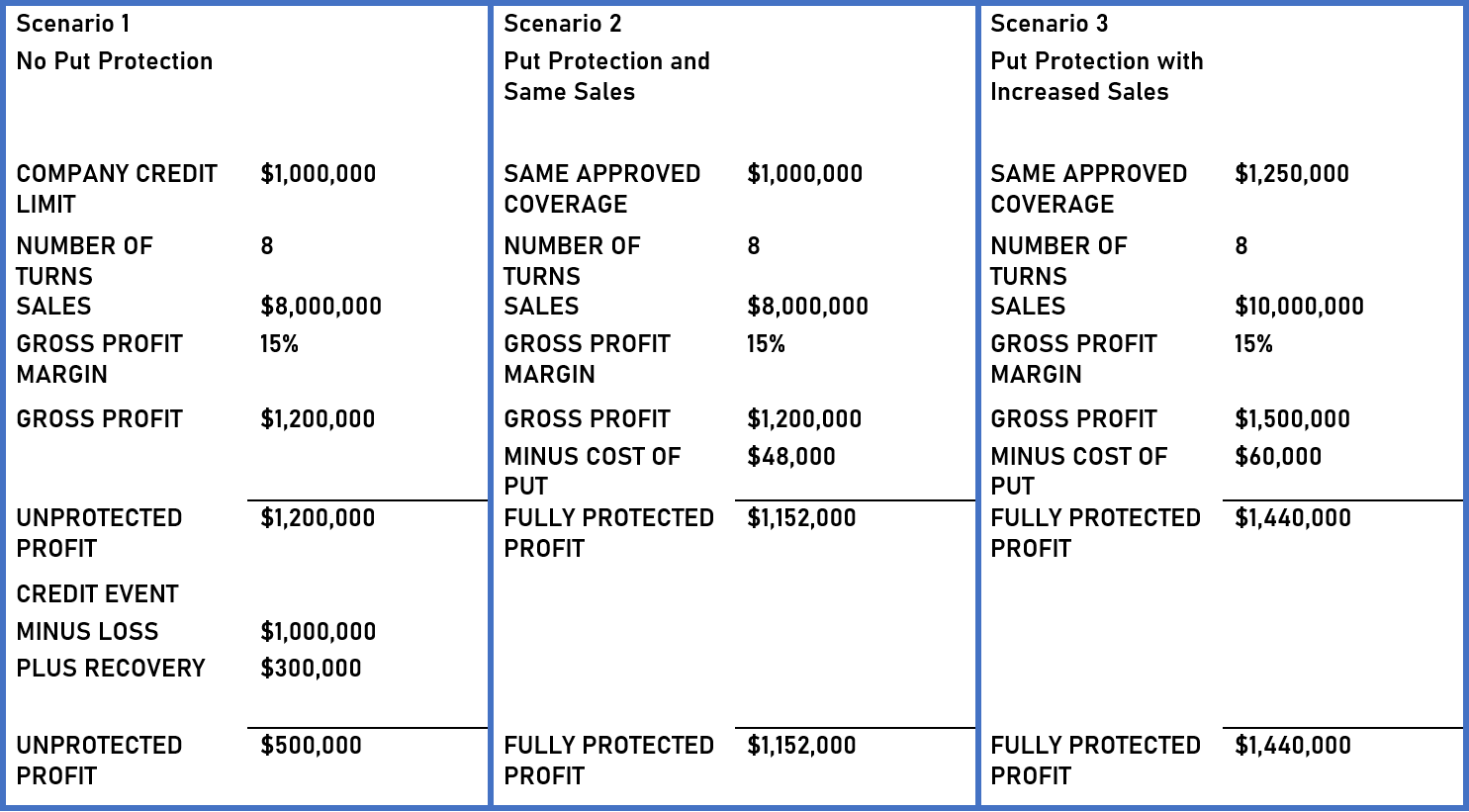

Here is an example depicting the benefit of the Put Option Contract:

Does a Receivable Put Option Contract Cover Slow-Pay or Protracted Default?

The Receivable Put is a loss-occurring contract and only covers Chap 11 & Chap 7 bankruptcy events. The bankruptcy filing must occur within the contract period or there is no coverage (even if sales occurred during contract period). The contracts are loss-occurring and do not provide coverage for protracted default or slow-pay.

Latest News

How (and When) to File A Claim for Late Payments

Overview We are often asked when should the insured file a claim for non-payment? And what documentation is needed...

11 Reasons for a Trade Credit Insurance Broker

1. Key Benefit Unlike a captive agent who represents one insurer, trade credit insurance brokers are independent and...

Major Country Risk Developments May 2023

Posted with permission from greatamericaninsurancegroup.com Overview There appears to be developments on the...

900 West Valley Road, Suite 701 | Wayne, PA 19087

Tel. 484-595-0100 Fax. 484-582-0111

P.O. Box 3665, Tyger Valley, Cape Town 7536 South Africa

Tel. 072-308-1112