What is Trade Credit Insurance?

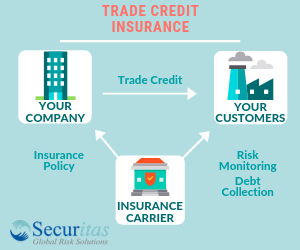

Trade Credit Insurance, sometimes called Accounts Receivable Insurance, is a method of protecting a company’s accounts receivable against the risk that one or more key customers will fail to pay for goods and services. This type of insurance covers the risk of unpaid invoices that may arise as a result of protracted default, insolvency, or bankruptcy of a customer (also known as a buyer). Trade credit insurance protects your cash flow and covers your business with your customers so that when they fail to pay you or go under, your company still gets paid.

What are the Reasons to Invest in Trade Credit Insurance?

Large companies, and especially multinational entities, invest in trade credit, business credit, or export credit insurance for a variety of reasons, including:

1. Increased Sales and Expansion: When a company’s receivables are insured, they can safely sell more to existing customers, as well as expand into areas that would otherwise be too risky.

2. Improve Cash Flow: a credit insurance policy can improve your cash flow by reducing the number of days a sale can be outstanding. It also allows for the outsourcing of debt collection services at no extra cost.

3. Better Financing Rates from Your Lender: Lenders look favorably on companies that have taken the added measure of protection that trade credit insurance offers. They will typically lend more capital for insured receivables and may reduce the cost of funds.

4. Reduce Reserves of Bad-Debt: Insuring a company’s accounts receivable can free up capital that would have originally been set aside in case the customer failed to pay. This means more liquid cash flow available for business initiatives.

5. The Protection Pays Off: Credit insurance policies may offset its own cost due to the way in which it allows a company to increase sales and profits without additional risk. In addition, credit insurance premiums are tax deductible.

Get Your Free Guide to Trade Credit Insurance

Get Your Free Guide to Trade Credit Insurance

How Much Does Trade Credit Insurance Cost?

The credit insurance premium is calculated by using a percentage of your turnover combined with level of risk. In other words, the number depends on who you are selling to, how much coverage your company needs for each customer, customer ratings, loss history, and the business sector.

On average, a trade credit insurance premium will be a fraction of one percent of company sales. The rate can be lower or higher depending on the variables listed above.

What Do I Need to Know About Policy Coverage?

Policies are written on an annual basis and can cover risks that are commercial or political. Once the policy is set, the credit insurer will assign the policyholder’s insured customers a specific credit limit, which is the amount covered if a buyer fails to pay.

Unlike other types of insurance, a trade credit insurance policy does not get filed away for renewal next year, it is a dynamic relationship. This type of policy can continue to change over the course of the year and the credit manager will play an active role in this process.

New buyers and additional coverage can be requested if needed. In this case, the insurance company will determine whether to approve the coverage by investigating the risk.

The insurer will continue to monitor your buyers and their creditworthiness. Companies we work with such as Atradius, Euler Hermes, and Coface will gather information about your customers by a variety of methods such as public records, receipt of financial statements, and information that is obtained through other policyholders that sell to the same buyer. This will be of great value to your company because the information you can access through the insurers database will help you make smarter business decisions.

Should you need to file a claim, our team of claims professionals will guide you through the process.

In a way, your credit insurer becomes an extension of your team. For example, if the records in the insurance carrier’s database suggest that your buyer is experiencing financial trouble, all policyholders that sell to that particular buyer will be alerted so that a plan can be set in place to avoid any losses before a claim is even filed.

How Do I Know Which Insurance Carrier to Choose?

There are many insurance carriers that offer trade credit insurance and each of them may differ in the amount that they decide to cover for your buyers, as well as their terms and conditions. Having a deep understanding of each of these differences will help you decide the best option for your company.

A trade credit insurance broker is invaluable in this process. Kirk Elken and Peter Seneca have over 35 years in the area of trade credit insurance. At Securitas Global Risk Solutions, we work for your company’s business interests, not the insurance carrier’s.

First, we work to understand your business needs and financial goals, key buyers, and credit exposures. Then, we send your policy application to multiple insurance carriers for quotes, which include buyer coverage commitments and proposed terms and conditions.

Next, we schedule a meeting to review the results. Using our knowledge of the insurance carriers, we can advise you on which policy will be best suited for you in terms of premium price, coverage, and advantages or disadvantages of working with each carrier.

After working together to elect the best policy at the most competitive price, we continue to work with and negotiate with the insurance carriers as your needs evolve.

Does it Cost More to Use a Trade Credit Insurance Broker?

There is no additional cost to you for using a trade credit insurance broker. This means that on a given insurance policy, your rate will be the same whether you decide to undertake the process alone by going directly to an insurance carrier or work with a trade credit insurance broker.

In fact, you are likely going to pay less on your premium because you have your choice of multiple carriers, rather than being locked into one.

In Summary

Trade credit insurance is different than traditional insurance. It covers accounts receivable so that you can protect your company against buyer insolvency, slow-pay, and bad debt. In addition, a trade credit insurance policy is a partnership with the insurance carrier that can provide their database information and knowledge to improve your trade decisions. Companies can also benefit from trade credit insurance through its ability to affect your sales expansion to new and existing buyers.

Navigating the world of credit insurance and the insurance claims process can be complicated and challenging. Using a broker like Securitas Global Risk Solutions gives the balance of power back to the client in the form of our knowledge of the industry, our understanding of your company, and our ability to provide you the carrier that offers the best coverage at the lowest rate.

Why Securitas?

As an insurance broker rather than an insurance agent, Securitas Global Risk Solutions is able to apply to multiple carriers to find the best contract, with the most coverage, for the least cost. A carrier’s agent can only advise you as to that carrier’s specific contract. We have a team of experts who are available to you 24/7 to answer any questions or concerns. Additionally, our service comes at no charge to you.

Get Your Free Guide to Trade Credit Insurance

Get Your Free Guide to Trade Credit Insurance