Posted with permission from greatamericaninsurancegroup.com Overview There appears to be developments on the...

Top 5 Benefits of Trade Credit Insurance

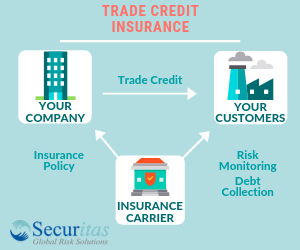

How does trade credit insurance work?

Trade credit insurance is a type of insurance that protects businesses from the risk of non-payment by their customers. It works by providing coverage for losses that result from a customer’s failure to pay for goods or services delivered by the insured business. The insurance company assesses the creditworthiness of the business’s customers and sets credit limits for each customer. If a customer fails to pay, the insurance company will cover the insured business for a percentage of the loss, typically between 75% an 95% of the amount owed. The cost of trade credit insurance is typically based on the insured business’s sales volume, the creditworthiness of its customers, and the level of coverage desired. Five benefits of trade credit insurance include the following:

1. Facilitate Sales

Open account credit terms can facilitate sales by making it easier for customers to purchase goods or services from a business. With open account credit terms, the customer is allowed to purchase goods or services on credit and pay for them at a later date, typically within 30 to 90 days. This can be particularly attractive to customers who may not have the funds to pay for the purchase upfront, but who are confident they will be able to pay within the credit term period. By offering open account credit terms, businesses can attract more customers and increase sales volume. However, it is important for businesses to assess the creditworthiness of their customers and manage their credit risk appropriately to minimize the risk of non-payment.

2. Protect Against Credit Losses

Credit insurance protects the insured from credit loss by providing coverage for losses that result from a customer’s failure to pay for goods or services delivered by the insured business. The insurance company assesses the creditworthiness of the insured’s customers and sets credit limits for each customer. If a customer fails to pay, the insurance company will cover the insured for a percentage of the loss, typically between 75% and 95% of the amount owed.

In other words, if the insured experiences a credit loss due to non-payment from a customer, they can file a claim with the insurance company, and if the claim is approved, the insurance company will reimburse the insured for a portion of the loss. This helps to protect the insured’s cash flow and balance sheet, and can help them to continue operating their business even if they experience losses from non-payment by customers.

It is important to note that credit insurance policies typically have exclusions and limitations, and the insured must comply with certain terms and conditions in order to be eligible for coverage. Additionally, the insurance company will typically require the insured to maintain appropriate credit management procedures and documentation to help minimize the risk of credit losses.

3. Gain Access to Additional Working Capital

Trade credit insurance can help insured businesses gain additional working capital from lenders. This is because trade credit insurance provides protection against the risk of non-payment by the insured’s customers, which can improve the creditworthiness of the insured and make them a more attractive borrower to lenders.

When an insured business has trade credit insurance in place, lenders may be more willing to extend credit or offer better terms, as they have greater confidence that the insured will be able to repay the loan. This is because the insurance policy provides protection against the risk of non-payment, which reduces the lender’s credit risk.

In addition, some lenders may even require businesses to have trade credit insurance as a condition of obtaining certain types of financing. By providing additional protection against the risk of credit losses, trade credit insurance can help businesses obtain financing on more favorable terms, which can in turn help them to grow and expand their operations.

4. Buyer Credit Risk Evaluation

Credit insurers can help insured businesses evaluate the credit risk of their buyers. As part of the underwriting process, credit insurers typically assess the creditworthiness of the insured’s customers and set credit limits for each customer. This involves analyzing a variety of factors, such as the customer’s financial statements, credit history, payment behavior, and industry trends.

In addition to setting credit limits, credit insurers may also provide ongoing monitoring and reporting on the creditworthiness of the insured’s customers. This can help the insured to identify and mitigate credit risk more effectively, and can also help them to make more informed decisions about extending credit to new customers.

Some credit insurers may also offer other services to help insured businesses manage their credit risk, such as credit risk analysis tools, customer credit reports, and online credit monitoring services. By providing these services, credit insurers can help insured businesses to make more informed decisions about extending credit and manage their credit risk more effectively.

5. Leverage Insurers Global Underwriting Platform

Many credit insurers have global underwriting platforms that allow them to provide credit insurance coverage for businesses operating in multiple countries and regions around the world.

These global underwriting platforms typically involve a network of local offices and underwriters who are familiar with the local markets, regulations, and business practices in their respective regions. This allows credit insurers to provide more customized coverage and risk assessments for each individual market.

In addition to providing coverage for businesses in multiple countries, global underwriting platforms may also offer other services such as risk assessment tools, credit monitoring and reporting, and other resources to help businesses manage their credit risk across borders.

Having a global underwriting platform can be a significant advantage for businesses that operate internationally, as it can provide them with more comprehensive and effective protection against credit losses in a wide range of markets.

Securitas

Since 2004, Securitas Global Risk Solutions, LLC (“Securitas”) has helped clients develop credit and political risk transfer solutions that provides value on numerous levels. As an independent trade credit and political risk insurance brokerage, Securitas is focused on developing comprehensive solutions that meet the needs of clients, ensuring complete understanding of policy wording and delivering excellent responsive service.

This article was generated by artificial intelligence and reviewed by Kirk J. Elken for accuracy.

Recommended News

Major Country Risk Developments May 2023

Top 5 Benefits of Trade Credit Insurance

How does trade credit insurance work? Trade credit insurance is a type of insurance that protects businesses from the...

Major Country Risk Developments, February

Posted with permission from greatamericaninsurancegroup.com Overview Federal Reserve has dialed back on the pace of...

Get Your Free Guide to Trade Credit Insurance

Get Your Free Guide to Trade Credit Insurance