How does trade credit insurance work? Trade credit insurance is a type of insurance that protects businesses from the...

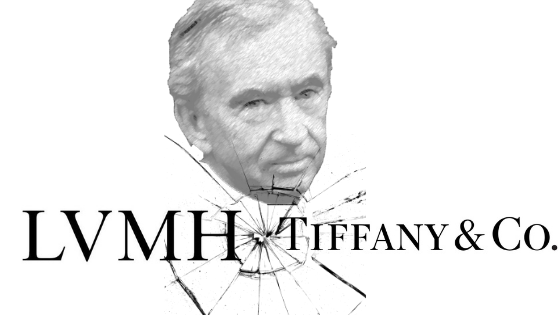

Upcoming LVMH, Tiffany & Co. Legal Battle Shines a Light on Political Risk

LVMH Legal Case

A dispute between luxury goods brands Moët Hennessy Louis Vuitton (LVMH) and Tiffany & Co. (Tiffany) highlights the continued political volatility of the global economy as companies and their home countries try to recover from the coronavirus downturn. In November 2019, LVMH reached an agreement to buy US-based Tiffany in a deal said to be worth $16.6 billion. The acquisition is set to be the biggest ever in the luxury goods market and would have added yet another iconic brand name to the LVMH conglomerate, which includes Christian Dior, Givenchy, and Dom Perignon champagne, along with dozens of brands across various sub-sectors of luxury goods.

Yet on September 9, nine months into the deal and two months before an agreed-upon November 24, 2020 deadline to complete the sale, Paris-based LVMH announced that it was backing out of the deal, asserting that Tiffany had been mismanaged during the pandemic and its poor performance in 2020 constituted a material adverse event. LVMH then added a political wrinkle to the story, noting that it had received a letter from French Foreign Minister Jean-Yves Le Drian requesting that it back out of the deal. The letter is said to have referenced anticipated trade tension between France and the United States in response to French efforts to tax technology companies, including industry giants like Google and Amazon. According to LVMH, the French minister’s letter constitutes a “valid, legally-binding order.”

Tiffany quickly contested LVMH’s moves, filing suit against LVMH in the Chancery Court of Delaware, which has jurisdiction over the international deal, and demanding that the deal be completed at its agreed upon price of $135 per share. The case has been fast-tracked for a January 2021 trial. Some industry watchers note that LVMH CEO Bernard Arnault, the wealthiest man in France, is simply unwilling to pay a pre-pandemic price for a company that has seen major losses due to the pandemic and only has only recently reported improved numbers. While the entire luxury goods sector has seen tremendous losses in 2020, larger companies like LVMH, with a more diverse range of products and capacity to shift to e-commerce, have been better able to adapt to the pandemic than have firms with greater dependence on retail outlets, tourism, or Chinese demand.

It remains to be seen whether LVMH’s attempts to scrap the deal will hold up under legal scrutiny, particularly its attempt to claim legally binding pressure from the French government. The brewing legal fight shows how the coronavirus pandemic has rattled economic relationships and highlights a trade environment that can be easily strained, even among long-time allies with considerable two-way trade like France and the United States. As the global economy works its way out of the pandemic and companies consider new operating models and markets, the need for an adequate political risk assessment is evident

Understanding Political Risk

Political risk insurance protects cross boarder investments, trade, permanent/mobile assets and contracts against various perils such as political violence, currency inconvertibility, foreign government intervention, expropriation, confiscation, nationalization, forced abandonment.

The COVID-19 pandemic has accelerated a tendency toward economic nationalism and protectionism in the current trade and investment environment. The LVMH/Tiffany case shows an example of how governments may seek to influence trade and investment deals to benefit domestic companies, or as part of a broader political strategy

As the LVHM/Tiffany gets litigated in the Chancery Court of Delaware watch to see if the demise of the transaction meets the following definition of an insured peril on a political risk policy:

“an act or a decision on the part of the government of the Buyer’s country, the Insured’s

Country or any other country specifically named in the Declarations, which prevents the

performance of the Commercial Contract.”

Political risks can drastically impact a company’s investment in a host country. Foreign government intervention or political violence can render a company unable to operate or withdraw their capital from a host country. Yet, as the global economy slowly recovers from the depths of the pandemic downturn, exporters will need to be aware that as new opportunities are created overseas, a proper assessment of both credit risk and political risk, and consideration of political risk insurance is prudent.

See Securitas’ Guide to Political Risk Insurance or contact Securitas to learn more.

Since 2004, Securitas Global Risk Solutions (“Securitas”) has helped clients across the United States develop credit and political risk transfer solutions that provides value on several levels. As a specialty independent trade credit and political risk insurance broker, Securitas is focused on developing comprehensive solutions that meet the needs of their clients, ensures complete understanding of policy wording and delivers responsive excellent customer service.

Recommended News

Top 5 Benefits of Trade Credit Insurance

Major Country Risk Developments, February

Posted with permission from greatamericaninsurancegroup.com Overview Federal Reserve has dialed back on the pace of...

Major Country Risk Developments January 2023

Posted with permission from greatamericaninsurancegroup.com Overview The global economy faces several uncertainties in...