As we exit the COVID-19 pandemic, the economy appears to be aggressively recovering, fueled by pent-up consumer demand, low interest rates and cash from government stimulus programs. First quarter GDP grew at 6.4%. The Biden Administration just announced a $6 trillion budget, and currently negotiating with Congress for an infrastructure bill which will add another $1 – $2 trillion into the economy over the next several years. While largely positive, this combination has raised concerns about inflation as the prices of commodities, residential real estate, and basic food staples, transportation and travel are increasing. The Consumer Price Index rose 4.2% in April, the largest increase in twelve years.

Due to historically low interest rates, investors seeking higher yields are pouring cash into equities, real estate and alternative investments, such as cryptocurrencies, raising asset bubble concerns. The S&P 500 trailing twelve months (TTM) PE ratio is 31.36 vs. the thirty year average – 23.32. The median existing home price in April was $314,600, 19% year over year increase. Even with recent correction the crypto-currency market is now roughly $1.5 trillion, up nearly 600% from a year ago.

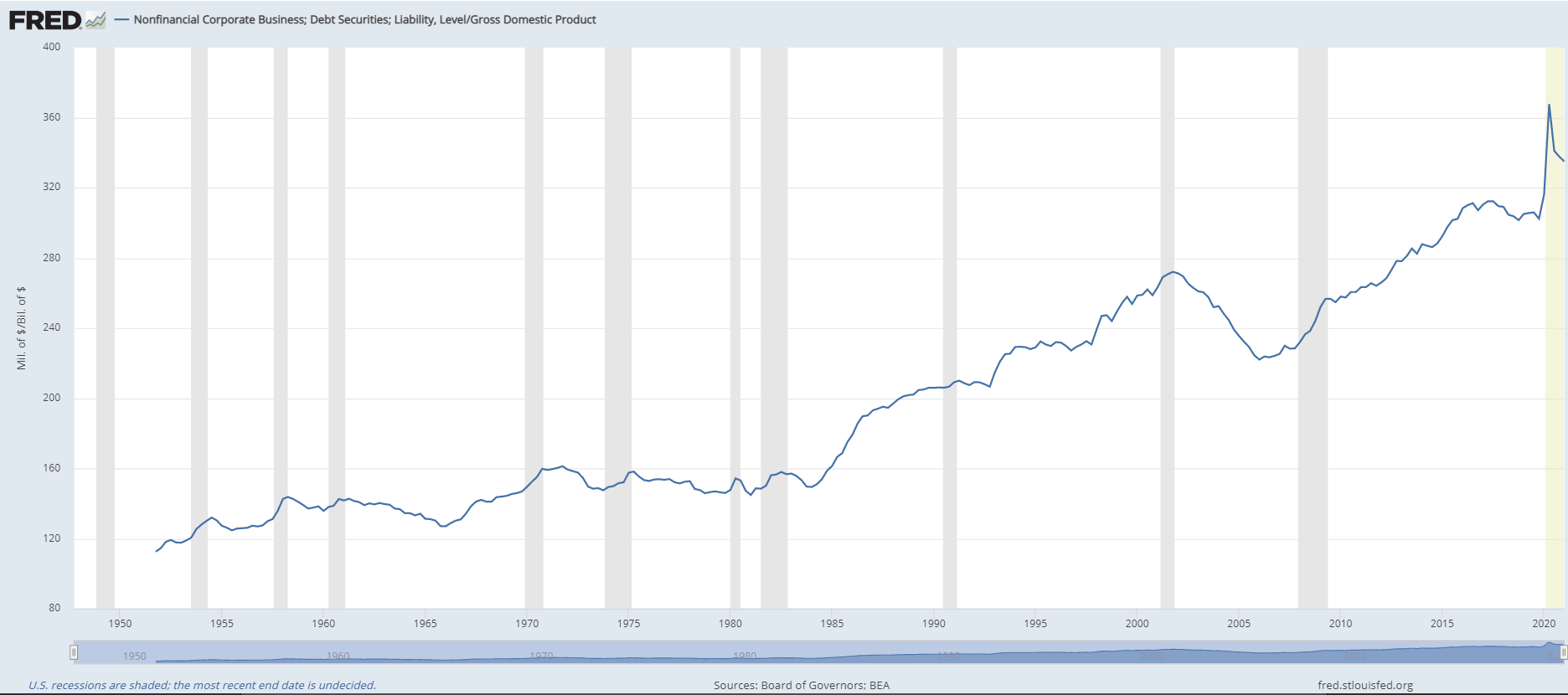

Less widely discussed however is the increased debt levels that corporations have taken on over the last ten years.

According to the Federal Reserve and Securities Industry and Financial Markets Association, large U.S. companies now face the highest levels of debt on record – more than $10.5 trillion. This figure doesn’t include small and middle market company debt estimated to be an additional $5 trillion.

Source: Federal Reserve Economic Data| FRED| Federal Reserve Bank of St. Louis

While the coronavirus pandemic contributed to increased borrowing levels (nonfinancial corporate debt outstanding has grown by $1 trillion in two years), because of historically low interest rates, companies have been increasingly accessing cash through the debt markets since 2008 economic crisis.

Ten-year treasury yield:

Source: Federal Reserve of the United States

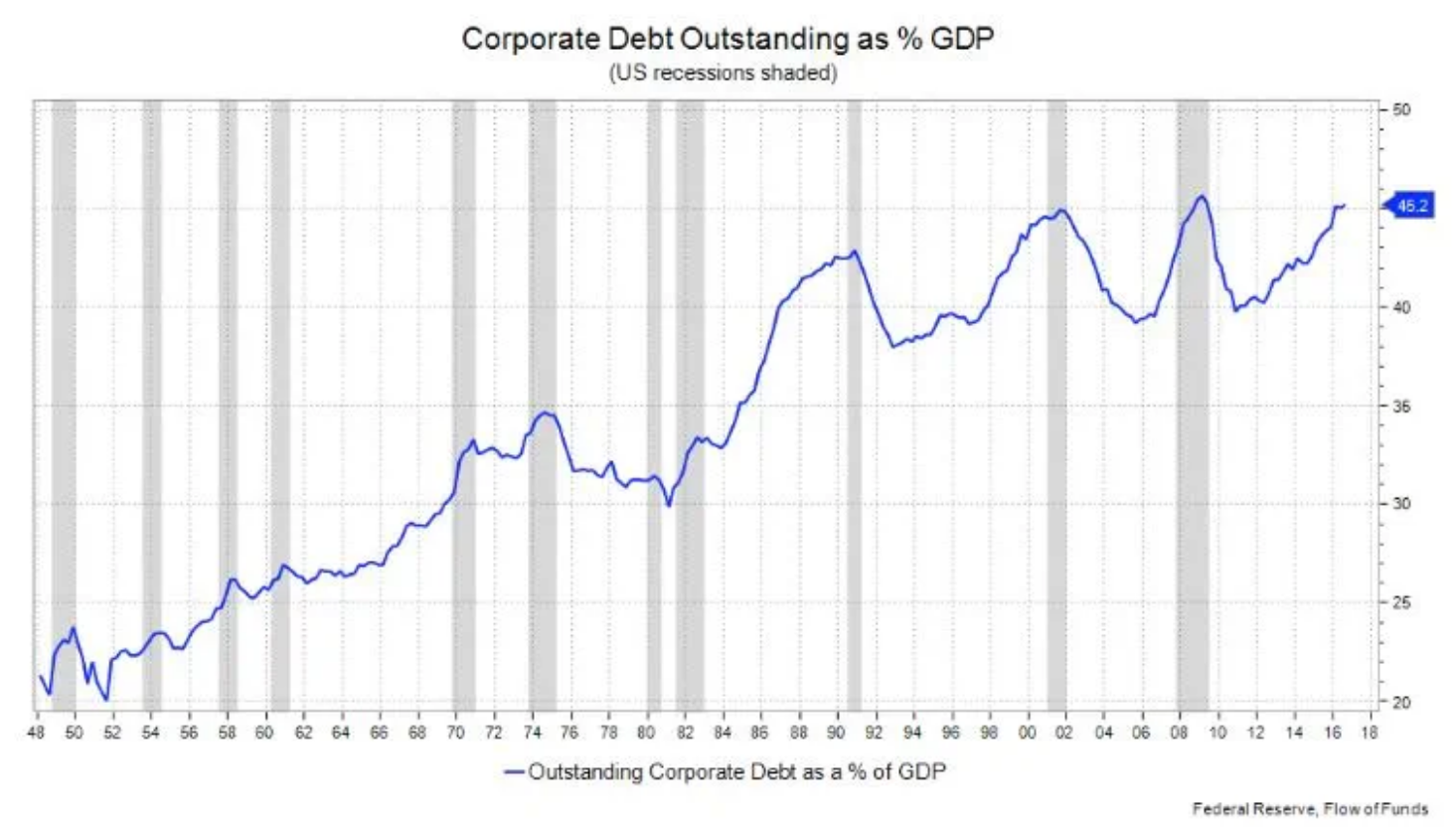

Low interest rates have encouraged companies to borrow, but instead of funding business investment, in many cases the money was used for share buybacks to bolster share prices. According to JPMorgan Chase (Harvard Business Review, Why Stock Buybacks Are Dangerous for the Economy, Jan 2020) roughly 30% of stock buybacks in 2016 & 2017 were funded by corporate bonds. The International Monetary Funds’s Global Financial Stability Report, issued in October 2019 highlights “debt-funded payouts” as a form of financial risk-taking by U.S companies that “can considerably weaken a firm’s credit quality”. The authors conclude that “when companies do these buybacks, they deprive themselves of the liquidity that might help them cope when sales and profits decline in an economic downturn.”

This has left many companies with less flexibility to weather interest rate increases, or an economic contraction.

Non-financial corporate debt now stands at 40% of GDP:

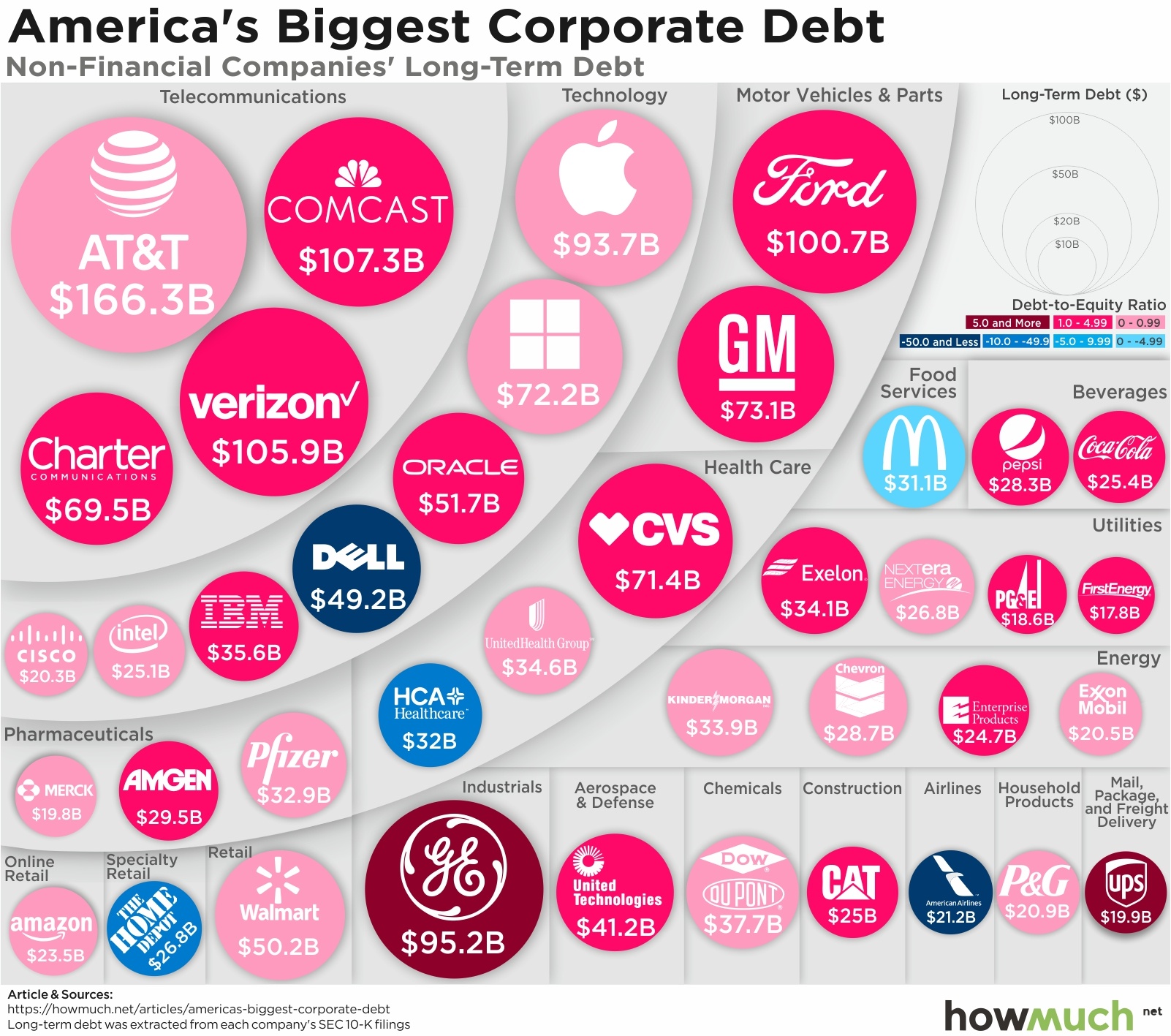

Non-Financial Companies with Long-Term debt:

Source: “HowMuch.net, a financial literacy website”

The economic growth forecast for the second quarter and remainder of 2021 are positive. For federal budgeting purposes, the Congressional Budget Office forecasts 2021 real GDP growth rate at 5.6%. The highest since 1984 when the GDP annual growth was 7.24%.

Given the increased liquidity and consumer demand, the Federal Reserve will have the difficult task of managing interest rates to reign in inflationary pressures. Higher interest rates could have the dual impact of increased debt service levels and slowing the economy, both of which would negatively impact a highly leverage business.

As the saying goes “Everything thing is fine, until it’s not”. Companies will have to continue to diligently monitor credit even as the economy improves. Trade credit insurance and “Put” option contracts are two tools to assist financial executives evaluate credit risk and protect their balance sheet.

Credit Insurance

Trade credit insurance can be an integral part of a comprehensive credit evaluation and risk management strategy. Credit insurance protects the seller from buyer nonpayment due to insolvency or slow-pay. Credit insurers maintain extensive credit databases and actively capture, update and monitor debtor credit information. They often provide early notification if a debtor’s credit quality deteriorates, or financial performance declines. This information helps credit management professionals determine if, or how much, credit can safely be extended to a buyer.

“Put” Option contract

If a debtor is uninsurable (debt is rated CCC+ or lower), a Put option contract might be available. Put option contracts are non-cancelable and protect the seller if the debtor files for bankruptcy during the contract term. The contract terms are generally based on debtor credit quality, tenor and amount. Put option contracts have been limited to debtors with publicly traded debt. However, with recent changes in the Put option market, they can now be written on private debtors as well if financials are available.

Since 2004, Securitas Global Risk Solutions has helped clients develop credit and political risk solutions. As independent trade credit and political risk specialists, we are focused on developing comprehensive solutions that meet the needs of our clients. Please feel free to call us with any questions, or if we can be of any assistance.

Notes:

William Lazonick, Mustafa Erdem Sakinc, and Matt Hopkins. “Why Stock Buybacks Are Dangerous for the Economy.” Harvard Business Review, Jan 7, 2020, pages 2-3

HowMuch.net. a financial literacy website

Federal Reserve Bank of St. Louis

Congressional Budget Office, Nonpartisan Analysis for the U.S. Congress

Let’s Get in Touch:

Telephone: 484-595-0100

Fax: 484-582-0111

Recommended News

Major Country Risk Developments May 2023

Posted with permission from greatamericaninsurancegroup.com Overview There appears to be developments on the...

Top 5 Benefits of Trade Credit Insurance

How does trade credit insurance work? Trade credit insurance is a type of insurance that protects businesses from the...

Major Country Risk Developments, February

Posted with permission from greatamericaninsurancegroup.com Overview Federal Reserve has dialed back on the pace of...