Expropriation Pressure

Mexico’s oil industry has become the target of what former U.S. ambassador to Mexico Antonio Garza, called “slow-rolling expropriation,” as the Mexican government exerts pressure on foreign oil investors. For example, in mid-2020, Mexico passed a new regulation that requires oil imports to be held for at least five days in facilities owned by PEMEX (Petroleos Mexicanos), Mexico’s state-owned oil producer and distributor. The move slows the delivery of foreign oil and forces companies to pay fees to PEMEX, a competitor in Mexico’s domestic market. In another example, US oil firm Talos Energy was instructed by the Mexican government to partner with PEMEX in oil exploration in the Gulf of Mexico despite Talos’ previous award of exclusive drilling rights in the area. These and other actions prompted a strongly-worded letter from US government officials in January 2021, accusing Mexico of holding up permits for foreign oil companies and writing regulations to favor Mexican companies.

PEMEX Performance

Much of the Mexican government’s interest in the oil industry is focused on propping up PEMEX, which was created after the oil industry was nationalized in 1938 and formerly held a 76-year monopoly over domestic production and distribution until the industry was deregulated in 2014.

Mexico’s current president, Andrés Manuel López Obrador—known as AMLO—opposed deregulation as an opposition politician and appears eager to restore PEMEX to a position of industry dominance. At the beginning of his presidential term in 2018, AMLO unveiled a plan for energy self-sufficiency centered on PEMEX. In May 2019, he hinted at creating an expropriation agency as part of his broader push to address the country’s income inequality. According to Gallup, ALMO’s current approval rating (62%) is four times higher than his predecessor’s (15%) who favored deregulation, suggesting ALMO has the political support necessary to implement these policies.

PEMEX Statistics in Brief

- In 2019, PEMEX posted a $36 billion loss even before the Covid-19 pandemic sent oil prices lower.

- Moody’s downgraded PEMEX’s creditworthiness to “junk” status in April 2020.

- By the end of 2020, PEMEX reported that it had missed its annual crude oil production targets for the sixteenth straight year and was carrying a financial debt of $110.3 billion.

- PEMEX is the world’s tenth largest crude oil producer and the nineteenth largest oil and gas company in the world.

- PEMEX employs over 120,000 people and supports the pensions of another 107,000 former employees.

- The company generates over a third of the Mexican government’s revenue.

Foreign and U.S. Oil Investments

Since 2014, major oil companies, such as Chevron and Shell, have made major investments in Mexico. Some recent deals include an estimated $5.7 billion investment in Gulf of Mexico deepwater exploration by Chevron, and another deepwater exploration effort estimated at $2.4 billion by Shell. It remains to be seen if expropriation concerns will dampen future oil investments, or potentially hamper Mexico’s trading relationship with the United States in general. The finalized U.S.-Mexico-Canada Agreement (USMCA) is less than a year old and both countries have strong oil and gas links. Mexico is a major market for US liquefied natural gas and petroleum exports. In return, Mexico is the second largest source of crude oil imported by the U.S. in 2020, behind only Canada.

Countering Risk

In a global economic environment still hampered by the Covid-19 pandemic, countries are impatient to find ways to protect revenue, create jobs, and address issues of development and income inequality exacerbated by the 2020 downturn.

In many countries, there are leaders who view protectionism or outright expropriation as a way to popularly assert national sovereignty, push back against alleged abuse by foreign interests, or to pursue broader social and economic goals.

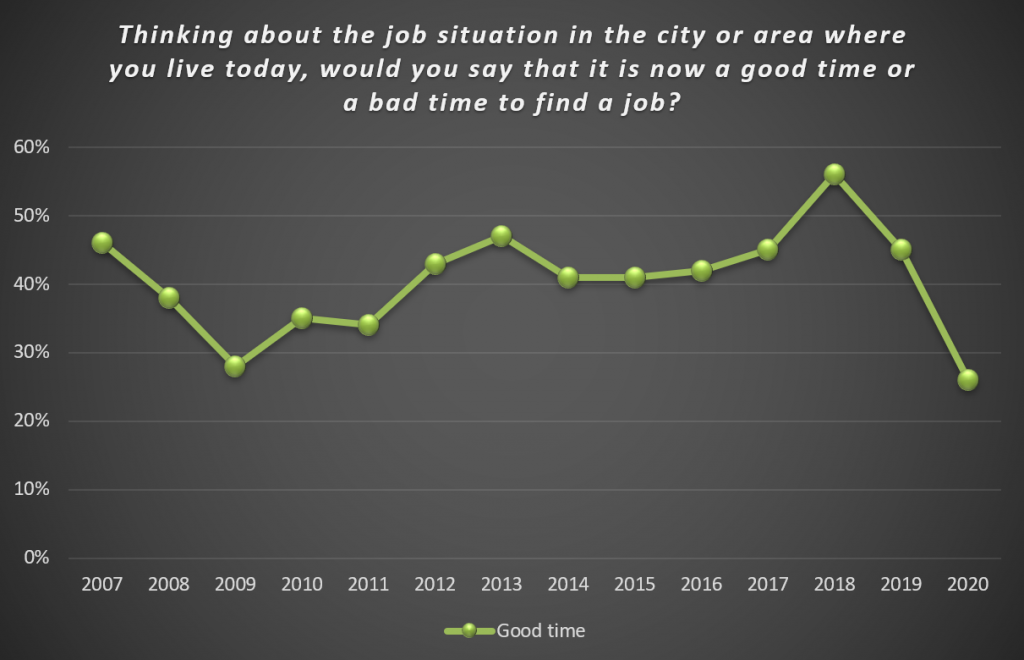

Though Mexico is classified as a middle-income country, it struggles with inequality as measured by a Gini coefficient score of just under 0.5, and data from the Gallup World Poll indicates life is getting more difficult for the average Mexican. In 2020, only 26% of Mexicans said it was a good time to find a job– the lowest amount Gallup’s recorded since it started tracking in 2007.

Source: Gallup, Inc.

Gallup also asks Mexicans to rate their life on a scale of zero to ten, with ten representing the best life possible. The average life rating in Mexico dipped to six – the lowest Gallup has recorded, and a full point below Mexico’s life rating during the great recession in 2009. Gallup finds that falling life ratings are often a precursor to political instability.

The government will be eager to boost Mexicans’ spirits and economic prospects. The viability of PEMEX, the country’s largest company, is seen as both economically important and as a symbol of national sovereignty. National sovereignty is often evoked in AMLO’s defense of Mexico’s recent interventions in the oil sector.

While the global economy has tremendous potential for growth post-Covid, investors should be aware of the risks that comes with investing in a country like Mexico with tremendous economic dynamism, but with a history of economic protectionism and expropriation.

Expropriation is just one example of political risk. Many investors purchase political risk insurance policies to protect their foreign investments from expropriation, nationalization, confiscation, currency inconvertibility, and/or political violence. A political risk policy can help a business pursue investments and opportunities more fully knowing that they have coverage in the case of political risk perils. It is crucial that businesses have adequate coverage and find a trustworthy broker to guide them through what they will need to protect their investments from harm.

See Securitas’ Guide to Political Risk Insurance or contact Securitas to learn more.

Since 2004, Securitas Global Risk Solutions (“Securitas”) has helped clients across the United States develop credit and political risk transfer solutions that provides value on several levels. As a specialty independent trade credit and political risk insurance broker, Securitas is focused on developing comprehensive solutions that meet the needs of their clients, ensures complete understanding of policy wording and delivers responsive excellent customer service.

Authors:

Let’s Get in Touch:

Telephone: 484-595-0100

Fax: 484-582-0111

Recommended News

Major Country Risk Developments May 2023

Posted with permission from greatamericaninsurancegroup.com Overview There appears to be developments on the...

Top 5 Benefits of Trade Credit Insurance

How does trade credit insurance work? Trade credit insurance is a type of insurance that protects businesses from the...

Major Country Risk Developments, February

Posted with permission from greatamericaninsurancegroup.com Overview Federal Reserve has dialed back on the pace of...