Used with Permission from atradiuscollections.com Despite rising inflation in the eurozone, we argue it has not yet...

Lithium Market Set to Boom – A Risk Focus on the Lithium Triangle

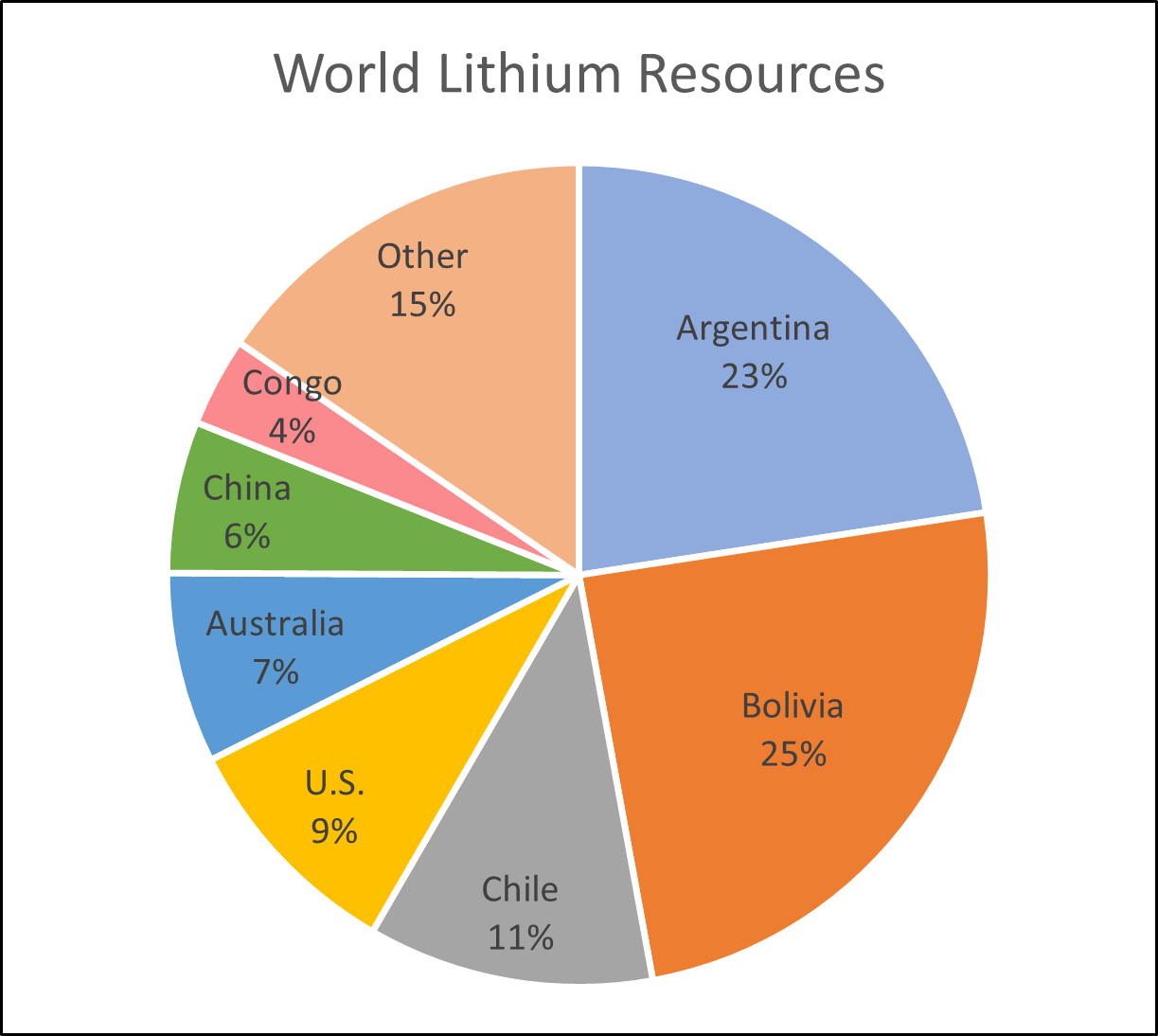

As the global economy continues to put the Covid-19 slump behind it, the market for electronic devices and an anticipated surge in electric vehicle demand has re-sparked interest in lithium, a highly reactive and conductive metal vital to the global economy. Found in only a handful of countries, with a small number of companies dominating its production, demand and prices have the potential to boom. In such a scenario, the potentially conflicting demands of consumers, mining companies, and lithium-rich countries warrants a look at political risk, particularly in South America’s Lithium Triangle, the home of 58% of the world’s lithium reserves.

Why Lithium is in Demand

The critical component of lithium-ion batteries, lithium’s demand corresponds to global demand for manufacturing electronics such as smartphones and electric cars, which are expected to have a 70% increase in demand in 2021 and throughout the decade, driven by consumer interest and by growing efforts in many countries to phase out internal combustion engine vehicles. In Europe, lithium-ion battery production is projected to increase from 28 GWh (gigawatt hours) in 2020 to 368 GWh in 2025. United States’ production capacity of the batteries is projected to more than double from 42 GWh in 2020 to 91 GWh in 2025 according to S&P global market intelligence, though it also projects the U.S. share of the market to decrease from 9% in 2020 to 6% in 2025. According to Seeking Alpha, lithium demand will increase by 600% by 2040.

Low Prices and a Potential Boom

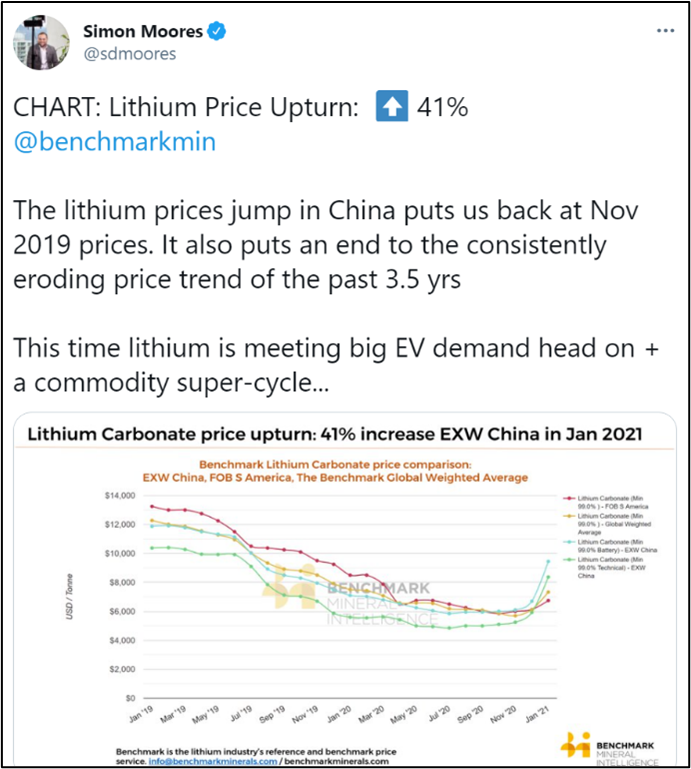

An oversupplied market in early 2020 saw a decline in lithium demand, mainly due to Covid-19. According to data from Trading Economics, (shown below), lithium prices declined 45% between July 2019 and July 2020.

Yet the chart above shows a recent spike in prices. Lithium prices jumped up 41% in the Chinese market in January 2021, causing a significant rebound in global price. Simon Moores, Managing Director of Benchmark Minerals (@sdmoores) noted the jump in early February.

Who is Buying Lithium?

China is by far the world’s biggest owner and buyer of lithium. China has gained a dominant position (called a “stranglehold” by one mining trade source) of the main precious metals in the electric vehicle supply chain: lithium, cobalt, and nickel. Additionally, China manufactures most electric vehicles made in the world. As countries move to transition away from internal combustion vehicles, a range of countries appear poised to increase domestic production of lithium-ion batteries and electric vehicles, with accompanying demand for lithium resources.

Where is Lithium Being Produced?

Lithium deposits and production are highly concentrated in a few countries, most notably Australia—the world’s largest producer of lithium—and the Lithium Triangle—Argentina, Bolivia, and Chile. The Lithium Triangle has 58% of the world’s identified lithium resources, according to the January 2021 U.S. Geological Survey. S&P Global also projects a 199% in South American lithium supply as new lithium brines (saline groundwater enriched in dissolved lithium) begin production and existing salars (a lithium brine reservoir) increase production. Between 2008 and 2018, Australian lithium production jumped from 24.7% of the global lithium supply to 60%.[12] This is largely due to its ability to export lithium to China. According to a 2018 survey by Bacanora lithium, four companies produce 73% of the world’s lithium:

- SQM (Chile)

- Tianqi Lithium (China): 46% of global lithium production

- Albermale Corporation (United States)

- Livent (formerly FMC) (United States).

(Tianqi Lithium owns an additional 24% of SQM.)

Political Risk in the Lithium Triangle

The anticipated surge in lithium demand and prices has renewed focus on South America’s Lithium Triangle.

Bolivia

Bolivia, owing to its large reserves and a recent political history, garners the most attention regarding political risk. The left-wing populism of former President Evo Morales has promoted state regulation of key resources for well over a decade. The Morales government nationalized the oil and gas sector in 2006 and power companies beginning in 2010.

Argentina

A painful economic recession in 2019 led to the electoral victory of current President Alberto Fernandez and Vice-President Christina Kirchner, a former president whose previous administration was noted for taking on heavy debt and state intervention into key sectors. Under her administration in 2012, Argentina nationalized YPF, an oil company. Just last year, the Fernandez administration expropriated its leading grain exporter, Vicentin, after it declared bankruptcy. While Fernandez is enjoying a bump in popularity, with 56% of Argentinians expressing confidence in the overall direction of the government in 2020, (up from 24% 2019), the country’s economic struggles remain. As with Bolivia, Argentina’s recent history of using expropriation and nationalization in economic policymaking makes it a political risk concern regarding how it plans to utilize its lithium reserves as demand grows.

The Lithium Triangle

Argentina

- Lithium resources: 19.3 million tons

- 2020 mine production: 6200 metric tons

- Largest deposit: Sal de Vida, 1.1 million metric tons

- Estimated percentage of GDP from mining: 5.3%

Bolivia

- Lithium resources: 21 million tons

- Annual mine production: about 400 metric tons

- Largest deposit: Salar de Uyuni, 5.5million metric tons

- Estimated percentage of GDP from mining:

- 13.5% (2015)

Chile

- Lithium resources: 9.6 million tons

- 2020 Mine production: 18,000 metric tons

- Largest deposit: Salar de Atacama 7.5 million tons

- Estimated percentage of GDP from mining: 10%, mostly from copper.

Sources: US Geological Survey, Mineral Commodity Summaries 2020; Statista.com, Major countries in worldwide lithium mine production from 2010 to 2020; TradingEconomics.com

Chile

Chile has been a major source of lithium in recent years, but has disappointed investors as other countries have outpaced its mining growth.

While Chile has generally rejected expropriation of lithium investment and has historically allowed private investment in the mining sector, the role of the state in taxing and regulating mining is tied up in current debates in Chile about constitutional change, environmental protection, and community rights. Chile’s legislature has re-opened a charged debate over mining royalities, while Chile’s President Sebastian Piñera vowed to facilitate private and state partnership to double the country’s output of Lithium carbonate to 230,000 metric tons.

Analysis

Despite the recent slump, lithium’s long-term profit potential remains strong owing its importance to the global economy. In many resource-rich countries, such as those in the Lithium Triangle, lithium mining’s economic potential will draw foreign investors who will face powerful political demands to see tangible community benefits from mining. This political mix raises risk concerns not just of increased taxation or regulation, but of expropriation and nationalization in countries with a history of state-intervention in key sectors such as mining.

For international investors, political risk insurance helps safeguard investments in the event of nationalization, expropriation, confiscation, currency inconvertibility, civil unrest and property damage.

Since 2004, Securitas Global Risk Solutions (“Securitas”) has helped clients worldwide develop credit and political risk transfer solutions that provides value on numerous levels. As an independent trade credit and political risk insurance brokerage, Securitas is focused on developing comprehensive solutions that meet the needs of clients, ensuring complete understanding of policy wording and delivering excellent responsive service.

Recommended News

Inflation expectations yet to decouple from ECB target

Liquidity matters: Corporates may need half a trillion of additional working capital requirement financing in 2021

Used with Permission from eulerhermes.com Summary In 2020, Working Capital Requirements in the West increased (+5 days...

Climate Change and its Impact on Country Risk

Used with Permission from Atradius.us Climate change raises country risk, but offers business opportunities as well....